GAO’s Financial Management and Assurance Mission Team

GAO’s workforce is organized largely by subject area, with many of its employees working in 1 of 14 mission teams. Today we’ll be putting the spotlight on the Financial Management and Assurance (FMA) team, which helps improve and transform the government’s financial management and operations.

Reports

FMA issues 3 types of reports and some standards:

- Financial Statement Audits: We annually audit the U.S. Government’s Consolidated Financial Statements and certain agencies’ financial statements, including the Internal Revenue Service (IRS), Federal Deposit Insurance Corporation, Securities and Exchange Commission, Consumer Financial Protection Bureau, and Federal Housing Finance Agency. The objective of these audits is to provide an opinion on the reliability of financial statements, including the effectiveness of the government’s or agencies’ internal controls over financial reporting. We also identify areas for improvement that are not significant enough to report in the financial statement audit reports, but warrant management attention, as illustrated in our management report on the IRS’s internal controls.

- Department of Defense (DOD) Financial Management: These reports assess DOD’s efforts to address its longstanding financial management issues. Recent reports have covered contract pay, funds management, and audit readiness.

- Government-wide and Civilian Agency Financial Management: Our reports and testimonies in this area includes improper payments, grants accountability, inspector general issues, and financial management issues related to health care, cost accounting, and pension plans.

- Accounting, Auditing, and Internal Control Standards: We establish and maintain a framework for conducting high-quality audits that are essential for management, accountability, and transparency over government programs. Specifically, we maintain the Green Book, which establishes internal control standards for federal agencies. Internal controls help an entity run its operations efficiently and effectively, report reliable information about its operations, and comply with applicable laws and regulations. In addition, we maintain the Yellow Book, which establishes government auditing standards. We also coordinate with regulators and others at the international, federal, and state levels.

For more information on our work, see our High Risk issue area on DOD Financial Management. You can also see our numerous Key Issues by checking the “Auditing and Financial Management” box on this page.

Impact

In fiscal year 2014, FMA identified $8.7 billion in financial benefits for the federal government as well as 235 other efficiencies. Directors from FMA testified at 4 congressional hearings and contributed to 3 hearings with other GAO teams.

A Closer Look at an FMA Report: Army Budgetary Resources

The National Defense Authorization Act for Fiscal Year 2013 requires DOD to describe how its Statement of Budgetary Resources (SBR) will be validated as ready for audit. As the largest component within DOD, the U.S. Army accounted for about 30 percent of DOD’s total spending for fiscal year 2013. DOD issued guidance to provide a standard methodology for its components to use to develop and implement financial improvement plans, improve financial management, and achieve audit readiness.

While the Army has made important progress in developing a financial improvement plan for its General Fund SBR efforts, we found that it did not fully follow DOD guidance to ensure that the plan considered the scope of what needed to be done to become audit-ready.

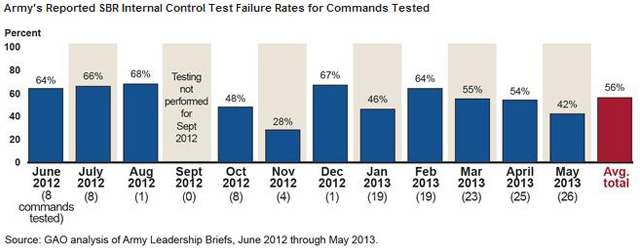

Further, the Army did not fully follow DOD guidance in documenting, assessing, and testing SBR controls. Based on test results from June 2012 through May 2013, the Army’s control tests had an average failure rate of 56 percent and identified extensive deficiencies such as lack of appropriate reviews or approvals.

Excerpted from GAO-14-60

This raised concerns about the likelihood that the Army would achieve audit readiness as planned.

- Questions on the content of this post? Contact Steven Sebastian at sebastians@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.