Human Capital: Characteristics and Administration of the Federal Wage System

Fast Facts

In this report, we review the administration of the Federal Wage System—the government's pay system for trade, craft, and labor hourly employees. And we examine characteristics of the system, such as which occupations and geographic areas are covered under it.

The FWS was originally intended to set these employees' pay rates in line with local market rates. However, subsequent congressional actions have linked FWS pay adjustments to those of the General Schedule pay system—the system that covers federal salaried workers. Agency officials told us this has resulted in FWS pay rates that are below or above local market rates.

Highlights

What GAO Found

The Federal Wage System (FWS) and General Schedule (GS) pay system cover about 192,455 federal blue-collar wage grade and 1.5 million federal white-collar GS employees as of 2023, respectively. Each pay system has its own separate laws, regulations, and policies that govern how it is to be administered.

FWS employees receive an annual pay adjustment based on pay comparisons between FWS and private sector jobs in defined wage areas that require similar skills and responsibilities. Congressional actions have capped the FWS pay adjustments so they do not exceed the average GS pay adjustment since fiscal year 1979. This is due to budgetary concerns, according to Office of Personnel Management (OPM) officials.

Since fiscal year 2004, congressional actions have required FWS employees to receive at least the same wage schedule adjustment in percentage terms that GS employees receive where they work. According to OPM and Department of Defense (DOD) officials, linking FWS pay adjustments to GS pay adjustments has resulted in FWS pay rates that are below or above prevailing (market) levels.

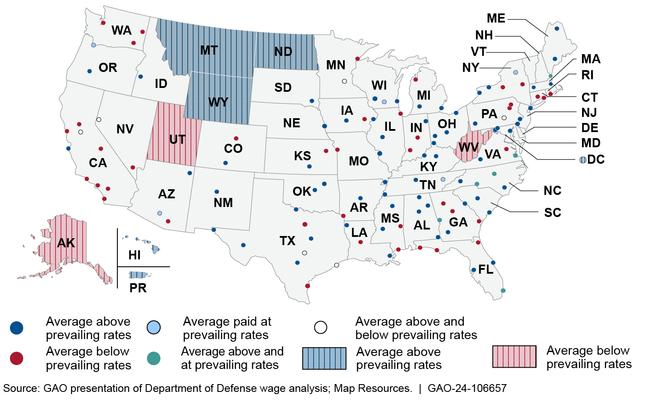

Average Wage Schedule Rates Compared to Prevailing Wage Rates for Nonsupervisory Employees in Appropriated Fund (AF) Wage Areas for Fiscal Year 2023

Note: Employees in AF wage areas are generally funded from the Treasury. In some cases, data showed that the average wage rates were both above and below prevailing (or market) rates where there are multiple wage schedules associated with a single AF wage area.

The process for administering the FWS includes: (1) establishing and combining wage areas, (2) conducting wage surveys, and (3) setting wage schedules. OPM defines wage areas based on geographic concentrations of FWS employees and private employment. Designated by OPM, DOD conducts annual surveys to collect data from private sector establishments within the wage areas and sets hourly pay rates for the wage schedules.

Why GAO Did This Study

The Prevailing Rate Systems Act of 1972 established the FWS for federal blue-collar employees who work in trade, craft, and labor. The act's underlying principles are to set pay rates for federal blue-collar workers in line with local prevailing (or market) rates and provide equal pay for substantially equal work. However, subsequent actions by Congress have limited the maximum pay adjustments granted to certain FWS employees, tying them to the average GS pay adjustment.

The Joint Explanatory Statement for the James M. Inhofe National Defense Authorization Act for Fiscal Year 2023 includes a provision for GAO to review the administration of the FWS. This report describes (1) characteristics of the FWS and GS pay systems and how they compare, and (2) the process for administering the FWS.

GAO reviewed legislation; OPM regulations, memorandums, guidance, and documentation; DOD guidance, data, and documentation; and Federal Prevailing Rate Advisory Committee reports. GAO also interviewed OPM and DOD officials and Federal Prevailing Rate Advisory Committee members (comprised of agency and labor management representatives) who provide input to OPM on defining wage areas.

DOD and OPM provided technical comments on a draft of this report, which GAO incorporated as appropriate.

For more information, contact Yvonne D. Jones at (202) 512-6806 or jonesy@gao.gov.