Employment Taxes: Timely Use of National Research Program Results Would Help IRS Improve Compliance and Tax Gap Estimates

Fast Facts

The IRS uses its National Research Program to study tax compliance issues. The program recently completed a study on employment tax returns filed between 2008 and 2010, but the IRS has not made plans to analyze the results of this study.

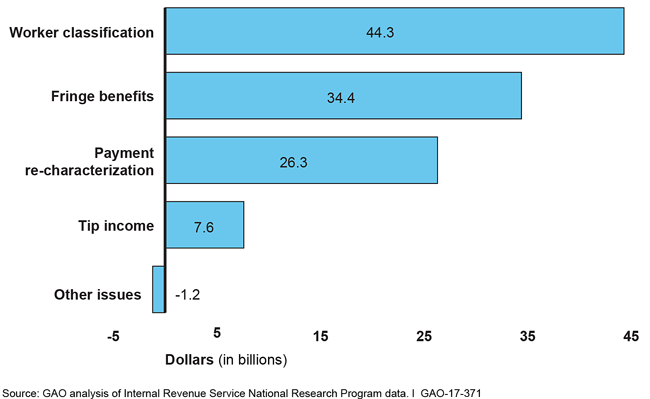

We looked at the study results and found that noncompliance in reporting taxable wages most frequently involved how workers were classified (and whether employers had to withhold and pay employment taxes for them), and fringe benefits (such as moving expenses). We recommended that the IRS develop plans to analyze the study's results to address noncompliance issues.

Wage Adjustments by Tax Examination Issue for Tax Years 2008 through 2010

Two bar graphs showing types of employment tax issues.

Highlights

What GAO Found

The Internal Revenue Service (IRS) uses its National Research Program (NRP) to study tax compliance issues. These NRP studies generally rely on detailed examinations of a random sample of tax returns and use different practices (including tools and procedures) than IRS's routine operational examinations. IRS recently completed the examinations for an NRP study on employment tax returns filed from tax years 2008 to 2010. This study was the first IRS had done on employment taxes in over 30 years. Based on IRS guidance, NRP results are intended to factor into IRS decisions about compliance areas and to be used to estimate the tax gap—the difference between taxes owed and those voluntarily paid on time. Although the examinations for the study are done, IRS has not developed formal plans to analyze the results to (1) identify areas of noncompliance, (2) address such noncompliance, or (3) update its employment tax gap estimate. IRS officials said they have not developed such formal plans due to competing research priorities and limited resources, and because the NRP results have not yet been finalized. Without completed analysis of the NRP employment tax results, IRS risks using outdated data to make decisions about compliance and areas of the tax gap to pursue.

GAO reviewed the available NRP study results on noncompliance and found that taxable wages for worker classification and fringe benefits were among the most frequently misreported and led to the highest wage adjustment amounts on average. Worker classification issues arise when employers misclassify employees as independent contractors or other nonemployees. If employees are misclassified, the employer's obligation to withhold and pay employment taxes is not established and goes unpaid. Fringe benefits issues involve property, a service, or cash received that should be treated as taxable wages but are not.

IRS carried over certain NRP practices to operational employment tax examinations, including tools to help plan, document, and report the results of examinations but IRS examiners who responded to GAO's survey identified additional improvements that could be made to operational examinations.

- More than 90 percent of examiners said that they would like to have a certain tool—electronic data on the information returns of employers—when operational examinations start instead of on request, which they said would help identify issues to examine sooner and put fewer burdens on taxpayers. Although IRS officials said that providing the tool when all examinations start would not be a good use of IRS resources, they did not have data to evaluate whether and when providing this tool would improve examinations.

- Half of IRS examiners who were asked about two specific NRP tools in GAO's survey were not aware of how to request them for use during operational examinations. According to IRS officials, these tools may only be used infrequently during employment tax examinations. However, ensuring IRS examiners are aware of how to access them would be in line with IRS's strategic goal of empowering employees with tools and training. Without examiners being aware of these tools and able to utilize them when needed, they may be limited in their ability to effectively examine employment tax returns.

Why GAO Did This Study

Employers report employment taxes for Social Security, Medicare, unemployment insurance, and income taxes to IRS. In fiscal year 2016, these totaled almost $2.28 trillion. Each year, IRS examines a small percentage of employment tax returns to check employer compliance (known as operational examinations).

GAO was asked to review how practices from NRP examinations could improve operational examinations. This report (1) evaluates how IRS plans to analyze the NRP results, (2) describes GAO's review of available NRP data, and (3) describes NRP practices IRS applied to operational examinations and assesses whether additional improvements could be made to operational examinations. GAO reviewed documentation, interviewed officials, and reviewed the NRP results. GAO also surveyed all IRS examiners who completed both NRP and operational examinations on ideas for improving operational examinations.

Recommendations

GAO recommends that IRS develop plans to analyze the NRP results in 2017 to address areas of noncompliance identified, and update its employment tax gap estimates; determine whether and when to provide certain data upfront before an examination starts; and periodically remind IRS examiners how they can access certain tools. IRS agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | To help ensure that IRS leverages lessons learned from the NRP examinations and effectively completes operational employment tax examinations, the Commissioner of Internal Revenue should develop and document plans to analyze the results in 2017 of the NRP employment tax study to identify the major issues of noncompliance. |

The Internal Revenue Service (IRS) has developed and documented plans to analyze the National Research Program (NRP) employment tax study, as GAO recommended in April 2017. In January 2018, IRS completed NRP data perfection activities and delivered the updated data to its data warehouse system. In April 2018, IRS provided a high-level data analysis plan to study the NRP employment tax data. This plan noted that IRS would be developing the analytical plan details such as by reviewing and comparing desired outcomes against NRP data elements to determine the necessary database queries needed and potential benefits. In October 2018, the Tax Exempt and Governmental Entities business unit provided a data analysis plan used to analyze variables of the NRP data. Lastly, as of December 2019, the Small Business/Self Employed business unit provided documentation of analysis of NRP data it completed in March 2019. By taking these steps to address this action, IRS will better ensure it understands taxpayer compliance behavior, which will help improve operational employment tax examinations going forward.

|

| Internal Revenue Service | To help ensure that IRS leverages lessons learned from the NRP examinations and effectively completes operational employment tax examinations, the Commissioner of Internal Revenue should develop and document plans for addressing the noncompliance identified in IRS's analysis of the NRP employment tax results. |

IRS has developed and documented plans for addressing the noncompliance identified in its analysis of the National Research Program (NRP) employment tax results, as GAO recommended in April 2017. In October 2018, the Tax Exempt and Governmental Entities business unit provided a plan used for analyzing the variables in its portion of the NRP data as well as a list of the types of employment tax noncompliance that it plans to pursue. In addition, the Small Business/Self Employed business unit provided a plan on the types of employment tax noncompliance that it plans to pursue based on analysis of the NRP data it completed in December 2019. By addressing this action, IRS is better positioned to identify and address compliance problems on employment tax returns.

|

| Internal Revenue Service | To help ensure that IRS leverages lessons learned from the NRP examinations and effectively completes operational employment tax examinations, the Commissioner of Internal Revenue should develop and document plans for assessing the results of the NRP employment tax study to estimate the current state of the employment tax gap. |

In response to GAO's April 2017 recommendation, Internal Revenue Service (IRS) officials said that after IRS analyzes the NRP data, it would use the results to update its estimate for the employment tax gap. In January 2020, IRS provided documentation that the tax gap estimates released in September 2019 incorporated the results from its NRP employment tax study for its employment tax gap estimate. By addressing this action, IRS can rely on tax gap estimates that incorporate current data to make decisions about allocating resources to operational employment tax examinations.

|

| Internal Revenue Service | To help ensure that IRS leverages lessons learned from the NRP examinations and effectively completes operational employment tax examinations, the Commissioner of Internal Revenue should determine whether and when to provide the Information Return Analysis System upfront for Small Business/Self-Employed division operational examinations based on criteria such as whether it would help identify more noncompliance, reduce taxpayer burden, and improve audit efficiency by reducing overall IRS costs (examiner versus campus costs). |

In response to this recommendation,in March and April 2018, IRS officials said that they determined that they could electronically provide the Information Return Analysis System (IRAS) data upfront. In August 2018, IRS provided documents to show that IRS issued a policy alert to notify IRS staff about the availability of IRAS for use on employment tax audits and their access to IRAS. IRS also provided documentation on training to IRS staff on how to access and use IRAS. With these actions, GAO is closing this recommendation.

|

| Internal Revenue Service | To help ensure that IRS leverages lessons learned from the NRP examinations and effectively completes operational employment tax examinations, the Commissioner of Internal Revenue should regularly remind employment tax examiners how they can access and request the CP2100 and cash transaction data for operational employment tax examinations. |

In response to this recommendation, in July 2017 IRS said it will provide reminders to examiners regarding the cash transaction data and the CP2100, hold training sessions, and include information on both tools on its internal website for examiners. In October 2017, IRS's TE/GE business unit provided documentation that it established annual reminders on the CP2100 and cash transaction data, which employees can also access on TE/GE's intranet. TE/GE also held a training session on using the CP2100 for employment tax examinations. During October 2018, the SB/SE business unit provided documentation from its employment tax website on a policy alert reminder for using FinCen for cash transaction queries; on an interim guidance and an Internal Revenue Manual section on requesting CP2100 notice information; on training provided during September 2018 on the above policy alert and the above guidance; and on planning for biennial training on the cash transaction and CP2100 topics. These actions by both IRS business units suffice to close this recommendation

|