Social Security Offsets: Improvements to Program Design Could Better Assist Older Student Loan Borrowers with Obtaining Permitted Relief

Highlights

What GAO Found

Older borrowers (age 50 and older) who default on federal student loans and must repay that debt with a portion of their Social Security benefits often have held their loans for decades and had about 15 percent of their benefit payment withheld. This withholding is called an offset. GAO's analysis of characteristics of student loan debt using data from the Departments of Education (Education), Treasury, and the Social Security Administration (SSA) from fiscal years 2001-2015 showed that for older borrowers subject to offset for the first time, about 43 percent had held their student loans for 20 years or more. In addition, three-quarters of these older borrowers had taken loans only for their own education, and most owed less than $10,000 at the time of their initial offset. Older borrowers had a typical monthly offset that was slightly more than $140, and almost half of them were subject to the maximum possible reduction, equivalent to 15 percent of their Social Security benefit. In fiscal year 2015, more than half of the almost 114,000 older borrowers who had such offsets were receiving Social Security disability benefits rather than Social Security retirement income.

In fiscal year 2015, Education collected about $4.5 billion on defaulted student loan debt, of which about $171 million—less than 10 percent—was collected through Social Security offsets. More than one-third of older borrowers remained in default 5 years after becoming subject to offset, and some saw their loan balances increase over time despite offsets. However, nearly one-third of older borrowers were able to pay off their loans or cancel their debt by obtaining relief through a process known as a total and permanent disability (TPD) discharge, which is available to borrowers with a disability that is not expected to improve.

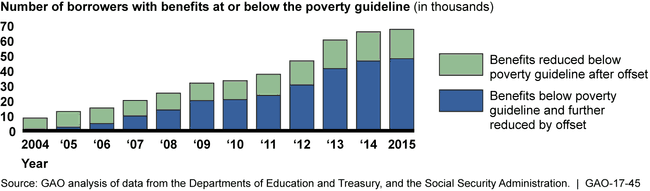

GAO identified a number of effects on older borrowers resulting from the design of the offset program and associated options for relief from offset. First, older borrowers subject to offsets increasingly receive benefits below the federal poverty guideline. Specifically, many older borrowers subject to offset have their Social Security benefits reduced below the federal poverty guideline because the threshold to protect benefits—implemented by regulation in 1998—is not adjusted for costs of living (see figure below). In addition, borrowers who have a total and permanent disability may be eligible for a TPD discharge, but they must comply with annual documentation requirements that are not clearly and prominently stated. If annual documentation to verify income is not submitted, a loan initially approved for a TPD discharge can be reinstated and offsets resume.

Impact of Offsets on Older Borrowers' Social Security Benefits

Why GAO Did This Study

An increasing number of older Americans have defaulted on their federal student loans, which are administered by Education, and have a portion of their Social Security retirement or disability benefits withheld above a minimum benefit threshold to repay this debt. Given that Social Security is the primary source of income for many older Americans, GAO was asked to review these withholdings, known as offsets.

GAO examined: (1) characteristics of student loan debt held by older borrowers subject to offset and the effect on their Social Security benefit; (2) the amount of debt collected by Education through offsets and the typical outcomes for older borrowers; and (3) effects on older borrowers resulting from the program design of relief options. GAO examined data from fiscal years 2001 through 2015 from Education's National Student Loan Data System and other administrative data from Treasury and SSA. GAO also examined aggregated data provided by Education and Treasury, reviewed documentation, and interviewed agency officials about Education's processes for providing relief from offset.

Recommendations

GAO suggests that Congress consider adjusting Social Security offset provisions to reflect the increased cost of living. GAO is also making five recommendations to Education, including that it clarify documentation requirements for permitted relief resulting from disability. Education generally agreed with GAO's recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To preserve the balance between the importance of repaying federal student loan debt and protecting a minimum level of Social Security benefits put in place by the Debt Collection Improvement Act of 1996, Congress should consider modifying Social Security administrative offset provisions, such as by authorizing the Department of the Treasury to annually index the amount of Social Security benefits exempted from administrative offset to reflect changes in the cost of living over time. | As of February 2025, Congress has not yet considered this matter. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Education | To improve program design for Social Security offsets and related relief options, the Secretary of Education should inform affected borrowers of the suspension of offset and potential consequences if the borrower does not take action to apply for a TPD discharge. Such information could include notification that interest continues to accrue and that offsets may resume once their disability benefits are converted to retirement benefits. |

On August 19, 2021 the Department of Education announced it is automatically canceling outstanding federal student loan debt for borrowers identified as being eligible for a Total and Permanent Disability (TPD) discharge. As a result, these borrowers will not have to take action to apply for a TPD discharge and they are no longer subject to Social Security offsets.

|

| Department of Education | To improve program design for Social Security offsets and related relief options, the Secretary of Education should revise forms sent to borrowers already approved for a TPD discharge to clearly and prominently state that failure to provide annual income verification documentation during the 3-year monitoring period will result in loan reinstatement. |

The Department of Education (Education) is engaging in short and long term steps to address this recommendation, as confirmed by an announcement on August 19, 2021. First, Education is indefinitely stopping requests sent for annual income verification. Next, Education will engage in negotiated rulemaking to propose eliminating the 3-year monitoring period. As a result, borrowers eligible for a TPD discharge would no longer be subject to loan reinstatement for failure to provide annual income verification documentation. Furthermore, the FUTURE Act (H.R. 5363), signed into law on December 19, 2019, requires Education to automate its income monitoring process for borrowers whose loans are discharged for total and permanent disability. In the event that Education does not remove the income monitoring requirement through rulemaking, Education would be required to automate this process, which would prevent borrowers from having loans reinstated for failure to provide income documentation.

|

| Department of Education | To improve program design for Social Security offsets and related relief options, the Secretary of Education should evaluate the feasibility and benefits of implementing an automated income verification process, including determining whether the agency has the necessary legal authority to implement such a process. |

H.R. 5363, the FUTURE Act was signed into law on Dec. 19, 2019. The law requires the Department of Education (Education) to automate the income monitoring process for borrowers whose loans are discharged for total and permanent disability. To do so, the law also directs the Secretary of Treasury to provide Education information on earnings for borrowers who have been approved for a total and permanent disability discharge during the 3 year monitoring period. These provisions of the FUTURE Act address our recommendation to Education by establishing Education's authority and directing the agency to automate the income verification process.

|

| Department of Education | To improve program design for Social Security offsets and related relief options, the Secretary of Education should inform borrowers about the financial hardship exemption option and application process on the agency's website, as well as the notice of offset sent to borrowers. |

The Department of Education initially agreed with the recommendation and said that they would include this change in upcoming revisions to the agency's web content. The Notice of Offset to borrowers is sent by Treasury and Education will share this recommendation with Treasury and discuss possible changes to the notice. On August 6, 2021, Education announced a final extension of the pause on student loan repayment and collections during the COVID emergency until January 21, 2022. During this time, defaulted borrowers are not subject to offset and do not need to request a financial hardship exemption. Prior to the pause, Education added information on its website to note that borrowers can request a review of their offset, but this information does not specifically say they can do so because of a financial hardship. In contrast, on the same website, Education informs borrowers they can request relief from wage garnishment for financial hardship. In September 2024, Education said that due to CARES Act payment pause and the budget, they plan to address this issue in December 2025. We continue to encourage the agency to specifically inform borrowers about the financial hardship exemption option and application process on the agency's website.

|

| Department of Education | To improve program design for Social Security offsets and related relief options, the Secretary of Education should implement an annual review process to ensure that only eligible borrowers are exempted from offset for financial hardship on an ongoing basis. |

On August 6, 2021, Education announced a final extension of the pause on student loan repayment and collections during the COVID emergency until January 21, 2022. During this time, defaulted borrowers are not subject to offset and do not need to request a financial hardship exemption. Prior to the pause, Education reported that it plans to fully automate their process for tracking hardships and other exemptions from offset as part of its redesign of the student loan financial services environment. In September 2024, Education said that due to CARES Act payment pause and the budget, they plan to address this issue in December 2025. In October 2024, Education officials noted that they plan to have an annual review process for financial hardship exemptions in place by September 2025. They provided documentation that includes instructions for the system to only approve hardships for 1 year and to prompt borrowers to reapply. We look forward to receiving confirmation from Education that the new annual review system with these requirements has been implemented.

|