Freight Rail Pricing: Contracts Provide Shippers and Railroads Flexibility, but High Rates Concern Some Shippers

Highlights

What GAO Found

While rail contracts and tariffs are similar, contracts offer the flexibility to customize rates and terms to a specific shipper, according to selected stakeholders GAO interviewed. Both contract and tariff rates are based on market factors, such as competition, according to representatives from the four largest U.S. freight railroads. However, they noted that in developing contract rates, a railroad will also examine factors specific to each shipper and may negotiate discounts in exchange for the shipper committing to provide a specified volume over the contract's duration. According to railroad representatives, the volume commitments negotiated in a contract allow the railroad to more efficiently allocate its resources and ensure consistent revenues. Also, selected shippers told GAO that they can more efficiently manage multiple shipping routes under one contract because of the stability in rates over the duration of the contract. In contrast, tariffs may be preferred for smaller shipments.

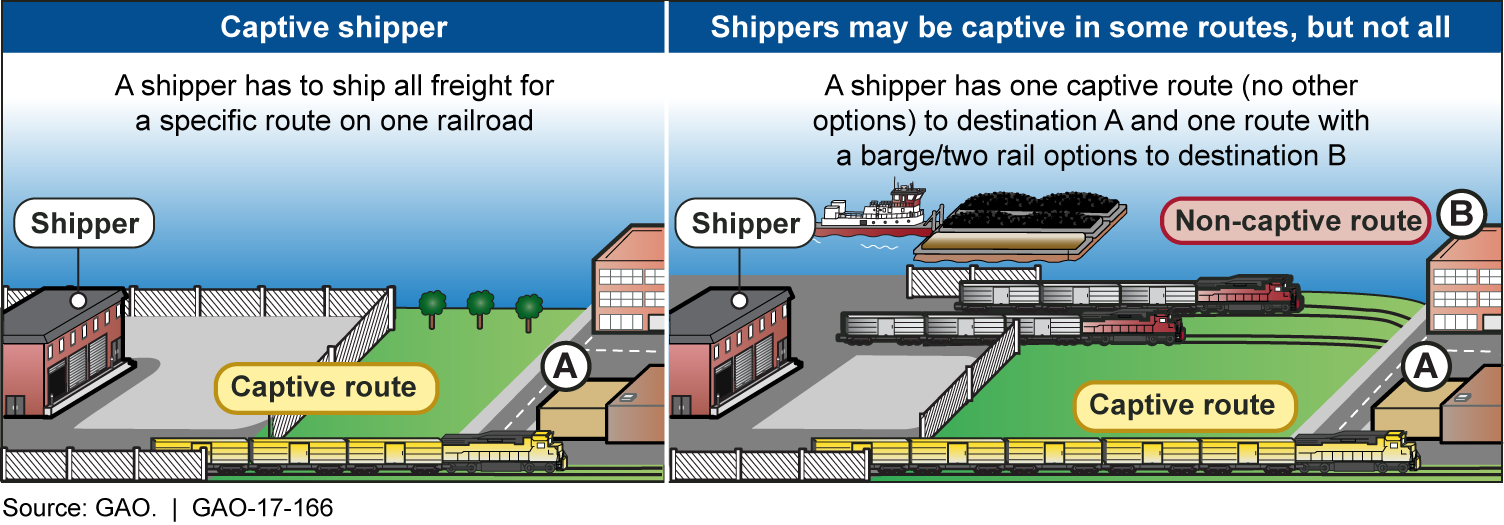

Despite the volume discounts contracts can offer, some selected shippers said that contracts that include rates for multiple origin-to-destination routes can contain high rates on some routes. This is particularly an issue for shippers that are “captive”—that is, shippers served by a single railroad without an economically viable transportation alternative.

Captive versus Non-Captive Routes for Freight Rail

Representatives of the four largest freight railroads said they charge what shippers are willing to pay to cover infrastructure costs for the entire rail network. However, according to selected shippers GAO interviewed, combining captive and non-captive routes together in one contract can compel shippers to accept some unreasonable rates. Shippers subject to contract rates they view as unreasonable cannot challenge those rates at the Surface Transportation Board (STB) because contracts are not subject to STB oversight. A railroad official said that a shipper may ask the railroad to switch rates the shipper views as unreasonable to a tariff. However, selected shippers said that tariff rates are generally higher than contract rates, so they are reluctant to forgo a contract with a mix of rates in favor of using a tariff. While the STB process for reviewing tariff rates was designed, in part, to protect captive shippers from unreasonably high rates, selected shippers said the process is complicated, time-consuming, and expensive. In 2016, STB began to reform the tariff review process with the goal of improving its efficiency.

Why GAO Did This Study

The nation's freight rail network is vital to the economy, moving about 40 percent of U.S. freight and generating over $73 billion in revenue in 2013. Railroads charge various rates for moving freight from a particular origin to a particular destination. A rate may be set by the railroad in a public pricing document—known as a tariff—or negotiated through a private contract with a shipper. While most freight ships under contract, some shippers have raised concerns with how railroads negotiate contracts that contain multiple origin-to-destination routes. Though shippers that use rail to transport freight under tariff may seek relief from STB for rates they view as unreasonable, STB has authority to review tariff rates, but not contract rates.

The Surface Transportation Board Reauthorization Act of 2015 included a provision for GAO to review rail transportation contract proposals containing multiple origin-to-destination routes. This report addresses (1) similarities and differences in shipping freight under a tariff versus a contract, and the potential benefits to using each, and (2) views of selected stakeholders on the implications of shipping freight under a tariff versus a contract. GAO analyzed STB data from 2005 to 2014, reviewed documents provided by and interviewed representatives of the four largest freight railroads, the Association of American Railroads, STB officials, and representatives of nine shippers selected to represent a mix of commodities transported by rail.

For more information, contact Susan Fleming at (202) 512-2834 or flemings@gao.gov.