Program Integrity: Views on the Use of Commercial Data Services to Help Identify Fraud and Improper Payments

Highlights

What GAO Found

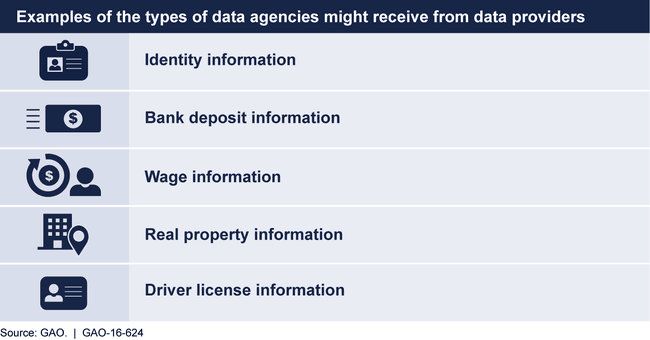

Officials from selected federal agencies told GAO that using commercial data services can help their agencies improve the efficiency of program integrity activities. For example, Internal Revenue Service (IRS) officials told GAO that using commercial data service providers to provide web and phone-based services to help authenticate certain taxpayer's identities likely allowed their staff to focus on other work rather than deal with large volumes of in-person requests for identity authentication. Commercial data services can also provide federal agencies access to private sector data, such as bank deposit information, that is not available from federal government sources. This financial information may help agencies to determine whether individuals have income from work or assets that indicate they are not eligible for certain programs, such as disability programs. Applicable laws generally require that agencies independently verify instances of matching data identified by computer matching programs before taking action and provide minimum notice to affected individuals. The figure below shows examples of the types of data that agencies may obtain from data service providers.

Federal agencies may consider various factors in determining whether data from commercial data services meet their information requirements for conducting program integrity activities. These factors include the accuracy of data; the currency and timeliness of data; the completeness of data; and technical aspects of using the data for these purposes, according to officials from agencies in GAO's nonprobability sample. For example, Department of Labor (DOL) officials told GAO that state Unemployment Insurance (UI) agencies could likely improve their ability to identify and prevent improper UI payments to claimants who return to work by obtaining commercially available wage data from a data service provider that are generally more recent than quarterly wage data that UI agencies receive directly from employers. DOL officials also told GAO that the agency is currently working with three states and a provider to conduct a pilot project to examine the use of the provider's payroll data to identify improper payments to UI recipients with disqualifying income from work. DOL expects the pilot to last up to 4 months.

Why GAO Did This Study

Federal agencies may use commercial data services in conducting program integrity activities designed to identify fraud and improper payments, which pose a significant risk to the integrity of federal programs. For example, federal agencies may obtain commercial data—subject to applicable laws and protections—that identifies individuals' deaths, income and assets, or other information that may help the agency determine whether individuals or entities are eligible for a government program or benefit.

GAO was asked to review issues surrounding the use of commercial data in conducting program integrity activities. This report identifies and describes the views of selected agency officials and commercial data service providers regarding (1) reasons selected agencies have used commercial data services in conducting program integrity activities; and (2) factors agencies may consider in determining whether commercial data services meet their information requirements for conducting program integrity activities.

To do this, GAO reviewed documents and conducted interviews with federal agency officials and representatives of commercial data service providers selected as part of a nonprobability sample of 12 entities selected to represent a range of program integrity activities and commercial data services. The information and perspectives that GAO obtained are not generalizable to other agencies and providers.

GAO is making no recommendations in this report, which incorporates various technical comments from the agencies.

For more information, contact Kathryn A. Larin at (202) 512-6722 or larink@gao.gov.