Federal Real Property: Commodity Futures Trading Commission Needs Better Leasing Guidance to Improve Cost-effectiveness

Highlights

What GAO Found

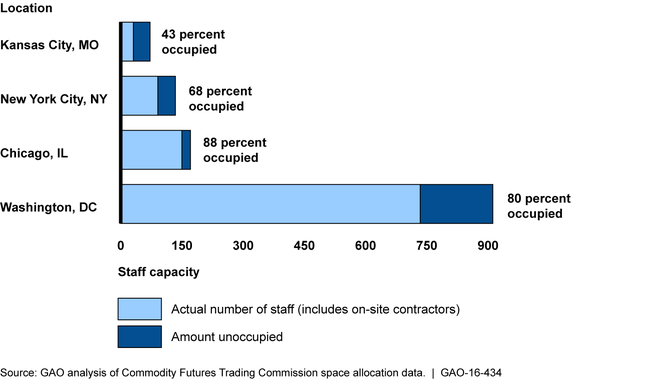

The Commodity Futures Trading Commission (CFTC) did not make cost-effective decisions consistent with leading government guidance for lease procurement and internal controls when planning for additional space in fiscal years 2008–2015. CFTC began planning for expansion in the fiscal year 2009 time frame—more than a year before the enactment of the Dodd-Frank Act in July 2010. CFTC renewed leases and expanded space in its Washington, D.C., headquarters and three regional offices in anticipation of receiving funding to hire additional staff but did not receive the amounts requested. As a result, CFTC has lease obligations for currently unused space some of which extends through 2025. Overall, the total occupancy level for all four offices combined was about 78 percent as of the end of fiscal year 2015, and each office has different occupancy levels, as shown in the figure below. CFTC has independent authority to lease real property, including office space. The two documents CFTC uses to guide the lease procurement process provide some high-level guidance on this process, but the documents do not establish specific policies and procedures to help ensure cost-effective decisions. By comparison, leading government guidance, from the General Services Administration (GSA) includes comprehensive details on lease procurement. The lack of this type of detail may have contributed to CFTC's making decisions that were not cost-effective.

Commodity Futures Trading Commission's Space Utilization by Office Location, Fiscal Year 2015

GAO identified several potential options that CFTC may pursue now and in the future to increase space utilization and improve the cost-effectiveness of its leasing arrangements: (1) relocating offices to less costly locations, (2) reducing office space requirements through enhanced telework, and (3) consolidating two regional offices—Kansas City and Chicago. CFTC officials told GAO that these options may not be feasible; however, the officials have not fully assessed these options or their potential for improving cost-effectiveness and do not have a timeline for doing so.

Why GAO Did This Study

The CFTC regulates certain financial markets, and the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) expanded its regulatory responsibilities. Prior to enactment of the Dodd-Frank Act, in anticipation of these increased responsibilities, the agency began planning for more space to accommodate additional staff in each of four office locations.

GAO was asked to review CFTC's staffing, leasing practices, and costs. This report examines: (1) the extent to which CFTC made cost-effective decisions and used leading government guidance in planning for additional space in fiscal years 2008 through 2015 and (2) potential options to improve the cost-effectiveness of CFTC's future leasing. GAO (1) reviewed applicable federal laws, regulations, and guidance that apply to real property leasing and CFTC's space-planning documents and leases for the fiscal years 2008 through 2015; (2) analyzed data and conducted interviews with key officials from CFTC and GSA; and (3) visited all four CFTC offices.

Recommendations

To help ensure cost-effective leasing decisions, GAO recommends that CFTC (1) ensure that its revised leasing policies and procedures incorporate leading government guidance and (2) establish a timeline for evaluating and documenting options to potentially improve space utilization and reduce leasing costs. CFTC generally concurred with GAO's recommendations but noted that it would not be able to take actions to reduce lease costs in the near term.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Commodity Futures Trading Commission | 1. To help ensure that the CFTC makes cost-effective leasing decisions, and considers options for reducing future lease costs, prior to entering into any new or expanded lease agreements, the Chairman of the CFTC should ensure that as CFTC revises its leasing policies and procedures, it includes comprehensive details on lease procurement that are consistent with leading government guidance and standards to assure cost-effective decisions. |

The Commodity Futures Trading Commission (CFTC) regulates certain financial markets, and the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) expanded its regulatory responsibilities. In April 2016, GAO reported that CFTC did not make cost-effective decisions consistent with leading government guidance for lease procurement and internal controls when planning for additional space in fiscal years 2008-2015. CFTC began planning for the expansion of its leased space in the fiscal year 2009 time frame-more than a year before the enactment of the Dodd-Frank Act in July 2010. CFTC renewed leases and expanded space in its Washington, D.C., headquarters and three regional offices in anticipation of receiving funding to hire additional staff but did not receive the amounts requested. As a result, CFTC has lease obligations for then unused space, some of which extends through 2025. CFTC has independent authority to lease real property-including office space-and is not required to obtain its space through GSA. CFTC followed some elements of leading government-leasing practices; however, the agency lacked comprehensive policies and procedures to guide efficient and cost-effective decisions for lease procurement. According to the Standards for Internal Control in the Federal Government, policies and procedures help ensure that actions are taken to address risks and are an integral part of an entity's accountability for stewardship of government resources. Specifically, CFTC used two documents-the 2009 Program of Requirements and the 2011 Statement of General Principles-to guide the lease procurement process that provided some high-level guidance on this process, but the documents did not establish specific policies and procedures to help ensure cost-effective decisions. By comparison, leading government guidance, from the General Services Administration (GSA)-GSA's Leasing Desk Guide-includes comprehensive details on lease procurement. The lack of this type of detail may have contributed to CFTC's making decisions that were not cost-effective. Therefore, GAO recommended that CFTC, prior to entering into any new or expanded lease agreements, revise its leasing policies and procedures to include comprehensive details on lease procurement that are consistent with leading government guidance and standards to assure cost-effective decisions. GAO confirmed that CFTC entered into a Memorandum of Understanding (MOU) with GSA, in November 2016, whereby GSA will procure and administer all new leases for CFTC consistent with leading government guidance, internal control standards and GSA policies and procedures. The MOU provides a framework by which GSA will apply its unique expertise in the leasing field to satisfy CFTC's real property space requirements, while ensuring compliance with appropriations laws and regulations applicable to real property transactions. By leveraging GSA's expertise in commercial leasing in managing CFTC leases, CFTC will be able to make reasonable management decisions to obtain space in an efficient and cost-effective manner, which meets the intent of GAO's recommendation.

|

| Commodity Futures Trading Commission | 2. To help ensure that the CFTC makes cost-effective leasing decisions, and considers options for reducing future lease costs, prior to entering into any new or expanded lease agreements, the Chairman of the CFTC should establish a timeline for evaluating and documenting options to potentially improve space utilization and reduce leasing costs including, but not restricted to, (1) moving offices to less costly locations, (2) implementing enhanced telework, and (3) consolidating the Kansas City and Chicago regional offices. |

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) expanded the Commodity Futures Trading Commission's (CFTC) role by adding the previously unregulated swaps market to its regulatory responsibilities. In April 2016, GAO reported that the CFTC began planning for the expansion of its leased space in the fiscal year 2009 time frame-more than a year before the enactment of the Dodd-Frank Act in July 2010. CFTC renewed leases and expanded space in its Washington, D.C., headquarters and three regional offices in anticipation of receiving funding to hire additional staff but did not receive the amounts requested. As a result, CFTC has lease obligations for unused space that are set to expire from fiscal years 2021 through 2025. GAO identified several options that CFTC could pursue now and in the future to increase space utilization and improve the cost-effectiveness of its leasing arrangements including, but not restricted to, (1) relocating offices to less costly locations, (2) reducing office space required through increased telework, and (3) consolidating two regional offices-Kansas City and Chicago. CFTC officials told GAO that these options may not be achievable before their current leases expire. However, the officials have not fully examined the current feasibility of these options or their potential for improving cost-effectiveness and do not have a timeline for doing so. To help ensure that the CFTC considers options for reducing future lease costs, GAO recommended that the CFTC establish a timeline for evaluating and documenting options to potentially improve space utilization and reduce leasing costs including, but not restricted to, (1) moving offices to less costly locations, (2) implementing enhanced telework, and (3) consolidating the Kansas City and Chicago regional offices. In 2019, GAO confirmed that CFTC has taken actions to reduce its lease costs. Specifically, the CFTC executed GSA Occupancy Agreements for a leasing solution for the agency's Kansas City, MO office; while moving the Chicago, IL and New York, NY offices from private sector leased space to Federal office buildings. Further, the CFTC is actively engaged with GSA's National Capital Region to begin the prospectus planning process for the Headquarters location. Lastly, the CFTC reduced its lease costs by successfully disposing of the Kansas City Office's 6th floor (7,922 rentable square feet). The CFTC estimated that this reduction in lease space saves the government over $327,000 over the remaining term of the lease which expires in 2021. As a result of these actions, the CFTC has increased space utilization and improved the cost-effectiveness of its leasing arrangements.

|