Retirement Security: Low Defined Contribution Savings May Pose Challenges

Highlights

What GAO Found

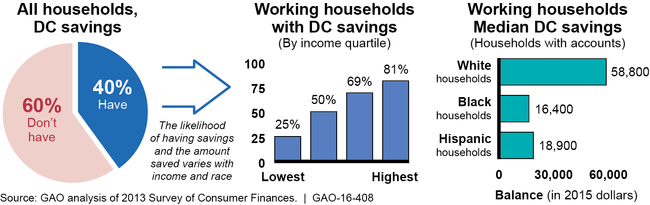

An estimated 40 percent of all U.S. households had some retirement savings in a defined contribution (DC) plan, such as a 401(k) plan, in 2013, and account balances varied by household income and race in recent years, according to the most recent data from the Survey of Consumer Finances (SCF). The 60 percent of all households (and specifically the 44 percent of working households) without any DC savings in 2013 may result from several factors. Approximately 39 percent of working households lacked access to, or were not eligible to participate in, an employer-sponsored DC plan at their job in 2013. Low-income households and Black and Hispanic households were even less likely to have access to a DC plan at their workplaces or to have DC savings. For example, GAO found that approximately 25 percent of working, low-income households had any savings in a DC plan compared to 81 percent of working, high-income households. Additionally, access and account balances declined for some, but not all, groups during the recent recession and recovery from 2007 to 2013. For example, Black working households' median DC plan balance declined by $14,700 (in 2015 dollars), from $31,100 in 2007 to $16,400 in 2013. Meanwhile, White working households' median DC balance did not change significantly over the same period. By 2013, White households' median DC balances were more than three times larger than for Black and Hispanic households'.

Estimated Household Defined Contribution (DC) Savings, by Income and Race, 2013

GAO projections of household DC plan savings at retirement vary widely across earning groups, and by key individual and employer decisions. These projections of DC savings accumulated over a career for a simulated group born in the same year differ from analysis of the SCF, which estimates current savings of different age groups. According to GAO's projections, households in the lowest earning group accumulated DC savings that generated lifetime income in retirement, as measured by an annuity equivalent, of about $560 per month on average (in 2015 dollars). Yet, 35 percent of this group had no DC savings at retirement. In contrast, households in the highest earning group saved enough to receive about 11 times more per month in retirement and only 8 percent had no DC savings. GAO also simulated several scenarios involving workers' decisions (e.g., participating in a DC plan or maximizing the employer match) and employer decisions (e.g., offering a DC plan or automatic enrollment) that increased the amount of projected DC savings available for retirement—particularly for low-earning workers. While GAO's projections of these scenarios show many possible ways to increase DC savings, they do pose potential tradeoffs for both workers and employers.

Why GAO Did This Study

Defined contribution (DC) plans, in which individuals save for their own retirement, have become the dominant form of retirement plan for U.S. workers. However, not all workers have access to or participate in such plans through their employer. DC plans also shift more risk to participants compared to traditional defined benefit (DB) pension plans. For example, a worker often needs to decide to participate in a DC plan, make regular contributions, and decide how to invest those savings before retirement. GAO was asked to review recent trends and future prospects for DC plan savings.

This report focuses on 1) recent trends in DC plan participation and account savings, and 2) how much households could potentially save in DC plans over their careers, and how key individual and employer decisions affect plan saving.

GAO analyzed household financial data from the Federal Reserve's triennial Survey of Consumer Finances (for 2004 through 2013, the most recent available). GAO also analyzed projected DC savings for a cohort of individuals born in 1997 using microsimulation models developed by the Policy Simulation Group. These simulation models allowed GAO to analyze the projected effect of certain decisions made by the employer and plan participant on DC savings at retirement. The selected simulations were informed by a review of the literature and interviews with retirement experts.

GAO is making no recommendations in this report.

For more information, contact Charles Jeszeck at (202) 512-7215 or jeszeckc@gao.gov.