Nonbank Mortgage Servicers: Existing Regulatory Oversight Could Be Strengthened [Reissued on April 14, 2016]

Highlights

What GAO Found

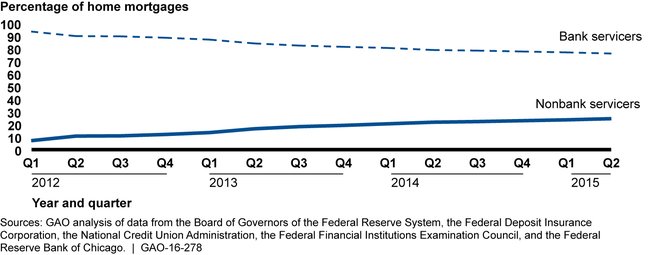

The share of home mortgages serviced by nonbanks increased from approximately 6.8 percent in 2012 to approximately 24.2 percent in 2015 (as measured by unpaid principal balance). However, banks continued to service the remainder (about 75.8 percent). Some market participants GAO interviewed said nonbank servicers' growth increased the capacity for servicing delinquent loans, but they also noted challenges. For example, rapid growth of some nonbank servicers did not always coincide with their use of more advanced operating systems or effective internal controls to handle their larger portfolios—an issue identified by the Consumer Financial Protection Bureau (CFPB) and others.

Share of Home Mortgages Serviced by Bank and Nonbank Servicers, from First Quarter 2012 through Second Quarter 2015

Note: GAO measured the quantity of mortgages using the total unpaid principal balance of all home mortgage loans outstanding. GAO estimated the amount of mortgages serviced by banks as the sum of the unpaid principal balance of mortgages that banks report holding for investment, sale, or trading plus the unpaid principal balance of mortgages that banks report servicing for others. GAO estimated the amount of mortgages serviced by nonbank servicers as the difference between the total amount of mortgages outstanding and the amount serviced by banks.

Nonbank servicers are generally subject to oversight by federal and state regulators and monitoring by market participants, such as Fannie Mae and Freddie Mac (the enterprises). In particular, CFPB directly oversees nonbank servicers as part of its responsibility to help ensure compliance with federal laws governing mortgage lending and consumer financial protection. However, CFPB does not have a mechanism to develop a comprehensive list of nonbank servicers and, therefore, does not have a full record of entities under its purview. As a result, CFPB may not be able to comprehensively enforce compliance with consumer financial laws. In addition, the Federal Housing Finance Agency (FHFA) is the safety and soundness regulator of the enterprises. As such, it has indirect oversight of third parties that do business with the enterprises, including nonbanks that service loans on the enterprises' behalf. However, in contrast to bank regulators, FHFA lacks statutory authority to examine these third parties to identify and address deficiencies that could affect the enterprises. GAO has previously determined that a regulatory system should ensure that similar risks and services are subject to consistent regulation and that a regulator should have sufficient authority to carry out its mission. Without such authority, FHFA may lack a supervisory tool to help it more effectively monitor third parties' operations and the enterprises' actions to manage any associated risks.

Why GAO Did This Study

As of June 2015, about a quarter of the $9.9 trillion in outstanding home mortgages in the United States were serviced by nonbank servicers—non-depository institutions that perform such activities as collecting borrowers' monthly payments and modifying loan terms. After the 2007-2009 financial crisis, an increase in delinquent loans and other factors led some banks to exit the mortgage servicing business and created opportunities for increased participation by nonbank entities. GAO was asked to study the effects of the growth of nonbank servicers in the mortgage market. This report examines, among other things, recent trends in mortgage servicing and the oversight framework in which nonbank servicers operate. GAO analyzed mortgage industry data from January 2006 through June 2015; reviewed relevant laws and documents from regulatory and housing agencies and an industry group; conducted a literature review; and interviewed consumer groups, regulators and other agency officials, and market participants.

Reissued on April 14, 2016

Recommendations

Congress should consider granting FHFA authority to examine third parties that do business with the enterprises. In addition, CFPB should take steps to collect more data on the identity and number of nonbank servicers. FHFA agreed that there should be parity among financial institution regulators in oversight authority of regulated entities and third parties they do business with. CFPB agreed that more data could supplement existing information but noted that the current data limitation does not materially affect its work.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To ensure that FHFA has adequate authority to ensure the safety and soundness of the enterprises and to clarify its supervisory role, Congress should consider granting FHFA explicit authority to examine third parties that do business with and play a critical role in the operations of the enterprises. | As of February 2026, GAO's Office of General Counsel conducted a review of open congressional matters. No legislative action identified in the 119th Congress. Congress had not taken any action to grant FHFA explicit authority to examine third parties that do business with the GSEs, as recommended in our March 2016 report. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | To improve its ability to monitor the consumer effect of nonbank servicers, the Director of the Consumer Financial Protection Bureau should take action to collect more comprehensive data on the identity and number of nonbank mortgage servicers in the market--for example, by requiring the registration of all nonbank entities or the use of legal entity identifiers. |

At the time GAO made the recommendation, the Consumer Financial Protection Bureau's (CFPB) database has approximately 160 mortgage servicers that CFPB estimated to represent over 80 percent of market share of unpaid principal balance. CFPB has identified these servicers through various sources. To address GAO's recommendation, CFPB analyzed data on mortgage servicers using an additional source, the National Mortgage Licensing System (NMLS), and identified 880 servicers to be added to its list of servicers. Also, in its course of examination of mortgage subservicers, CFPB identified another 10 servicers. As a result, CFPB has a list of 1,050 mortgage servicing entities representing 87 percent of the mortgage servicing market by unpaid principal balance.

|