2015 Tax Filing Season: Deteriorating Taxpayer Service Underscores Need for a Comprehensive Strategy and Process Efficiencies

Highlights

What GAO Found

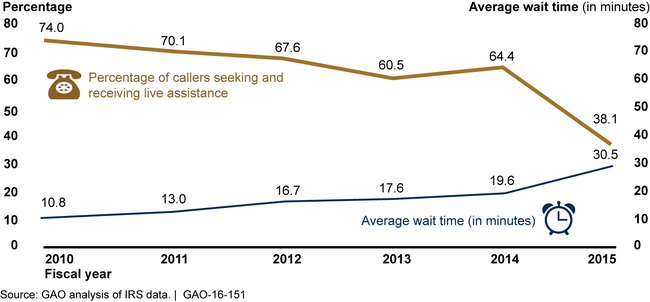

The Internal Revenue Service (IRS) provided the lowest level of telephone service during fiscal year 2015 compared to prior years, with only 38 percent of callers who wanted to speak with an IRS assistor able to reach one. This lower level of service occurred despite lower demand from callers seeking live assistance, which has fallen by 6 percent since 2010 to about 51 million callers in 2015. Over the same period, average wait times have almost tripled to over 30 minutes. IRS also struggled to answer correspondence in a timely manner and assistors increasingly either failed to send required correspondence to taxpayers or included inaccurate information in correspondence sent. IRS has taken steps to remind assistors to send correspondence, but does not have adequate controls to ensure that they send accurate correspondence before closing cases. GAO also found that the Department of the Treasury (Treasury) does not include correspondence performance goals in its performance plan, and therefore, does not have a complete set of measures to assess performance. The decline in service has coincided with a 10 percent reduction in IRS's annual appropriations, as well as resource allocation decisions by IRS to meet statutory responsibilities, such as implementing tax law changes and supporting information technology infrastructure.

IRS Telephone Service Deteriorated in Fiscal Year 2015

More importantly, GAO found that Treasury and IRS have neither developed nor have any plans to develop a comprehensive customer service strategy to define appropriate service levels and benchmark to the best in business or customer expectations as GAO has previously recommended. Without such a strategy, Treasury and IRS can neither measure nor effectively communicate to Congress the types and levels of customer service taxpayers should expect, and the resources needed to reach those levels. Similarly, while IRS officials and stakeholders reported few problems with processing individual tax returns, GAO identified some inefficiencies related to tax processing, such as premature correspondence with taxpayers and inadequate training for frontline staff. These inefficiencies warrant further evaluation to determine if additional improvements are needed.

Why GAO Did This Study

During tax filing season, IRS processes tax returns, issues refunds, and provides telephone, correspondence, online, and face-to-face services. GAO has reported that in recent years IRS has absorbed significant budget cuts and struggled to provide quality service. GAO was asked to report on the results of IRS's performance during the 2015 filing season. For this report, GAO assessed IRS's taxpayer service and individual income tax return processing. GAO also identified opportunities to streamline services and processes, among other issues.

GAO analyzed IRS documents and data, and observed operations at IRS processing and telephone sites. GAO compared IRS performance to prior years and its actions to federal standards for evaluating performance. GAO also interviewed IRS officials and external stakeholders, and conducted discussion groups with IRS frontline staff and managers.

Recommendations

Congress should consider requiring Treasury to develop a comprehensive customer service strategy in consultation with IRS. Treasury should update its performance plan to include goals for correspondence. IRS should assess the feasibility of a control to require assistors to send out required correspondence and evaluate return processing operations to identify inefficiencies.

Treasury neither agreed nor disagreed with GAO's recommendation to update its performance plan but said it would coordinate with IRS. IRS agreed with GAO's two other recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| To improve taxpayer service amid declining budgets and increased responsibilities, Congress should consider requiring the Secretary of the Treasury to develop a comprehensive customer service strategy in consultation with the Commissioner of Internal Revenue that (1) determines appropriate telephone and correspondence levels of service, based on service provided by the best in business and customer expectations; and (2) thoroughly assesses which services IRS can shift to self-service options. | In the Consolidated Appropriations Act 2017, which was enacted in May 2017, Congress directed IRS to develop a customer service plan with specific goals, strategies, and resources to achieve those goals and submit the plan to the House and Senate appropriations committees within six months after enactment of the act. As a result of Congress's actions, IRS has drafted a customer service plan that describes ranges for optimum telephone levels of service where IRS believes customer wait times are reasonable without the loss of productivity related to high assistor availability, and the steps taken to identify such optimal levels of service. By developing a customer service plan with optimal telephone levels of service, Treasury and IRS will more effectively convey to Congress the types and levels of customer service expected by taxpayers. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | To improve performance management of taxpayer services, the Secretary of the Treasury should update the Department's performance plan to include overage rates for handling taxpayer correspondence as a part of Treasury's performance goals. |

In March 2023, Treasury announced new performance measures for IRS correspondence. These measures included total ending inventory and percent of closures to receipts. According to Treasury, these measures provide a broader picture of the customer service representatives whose daily priorities include both answering phones and processing paper correspondence inventory. In addition, they provide a measure of the volume of work and the progress made in reducing inventory. While these measures track progress in responding to taxpayer inquiries, they do not provide an indicator or goal for the timeliness of those responses. As of the end of the 2024 filing season, overage correspondence (late responses) had increased from 37 percent in 2018 to 66 percent in 2024. Accordingly, inventory during that time increased from about 2 million in 2018 to 6.8 million in 2024. Without a measure and goal to assess timeliness in responding to correspondence, IRS is missing opportunities to provide optimum levels of taxpayer service. As such, we believe that our recommendation remains valid.

|

| Internal Revenue Service | To improve taxpayer service and gain efficiencies, the Commissioner of Internal Revenue should assess the feasibility of setting up a control in IRS systems requiring assistors to send out required correspondence to taxpayers prior to closing a correspondence case. |

In March 2017, IRS reported that, to ensure assistors issue required correspondence to taxpayers before closing their cases, the Accounts Management function has implemented ongoing quality improvement initiatives led by the Process Improvement/Customer Accuracy (PICA) team. The team's activities include site visits where it performs quality reviews to assess case work accuracy and identify emerging issues that require correction. IRS reported that the PICA team is working closely with the Centralized Evaluative Review team to monitor for specific case defects and identify further improvement opportunities. Further, IRS clarified guidance to employees on issuing closing letters by revising IRM 21.3.3, Incoming and Outgoing Correspondence/Letters, and providing a standardized closure job aid. This additional guidance and job aid will enable assistors to better identify errors on a taxpayer's return and send out required correspondence that better explains such errors to the taxpayer.

|

| Internal Revenue Service | To improve taxpayer service and gain efficiencies, the Commissioner of Internal Revenue should periodically conduct performance evaluations of IRS return processing operations to identify inefficiencies. The initial evaluation could include, for example, assessing when to correspond with taxpayers whose returns contain errors, collecting additional data on errors that IRS corrects, and closing training gaps that are hindering performance for units that process errors on individual taxpayer returns. |

In March 2017, IRS reported it had taken various actions in response to our recommendation. IRS officials stated that they supplemented their current annual reviews of tax return processing operations by considering additional data points, such as correspondence procedures, error code trends, and training opportunities, to identify any changes to internal controls that may yield increased efficiencies without compromising existing protections. For example, IRS reviewed Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return. As a result, IRS changed when to correspond with the taxpayer to request documentation to support the Health Coverage Tax Credit. IRS reported this resulted in numerous IRM procedural updates, which facilitated faster identification of Form 8453 and a new process to ensure the taxpayer had not previously submitted documentation before corresponding to request it. Finally, IRS also reported that in August 2016, it performed a comprehensive review of IRM 3.11.3, Returns and Documents Analysis, Individual Income Tax Returns, which resulted in minor procedural clarifications. In April 2017, IRS provided additional documentation that supported its claims. Regular review of its processes should position IRS to better identify potential efficiency gains and improve accuracy rates and taxpayer service.

|