Troubled Asset Relief Program: Treasury Could Better Analyze Data to Improve Oversight of Servicers' Practices

Highlights

What GAO Found

Through June 2014, the U.S. Department of the Treasury (Treasury) had disbursed about one-third of the $38.5 billion in Troubled Asset Relief Program (TARP) funds allocated to housing programs. However, the number of new borrowers added to the Home Affordable Modification Program (HAMP), the key component of the Making Home Affordable (MHA) program, began to decline in late 2013 after remaining relatively steady since 2012. Treasury has taken steps to assist more homeowners and also to address upcoming interest rate increases for borrowers already in the program (after 5 years, interest rates on modified loans may gradually increase to the market rate at the time of the modification). For example, Treasury has extended the HAMP deadline for a third time to at least December 31, 2016, and required servicers to inform borrowers about upcoming interest rate changes.

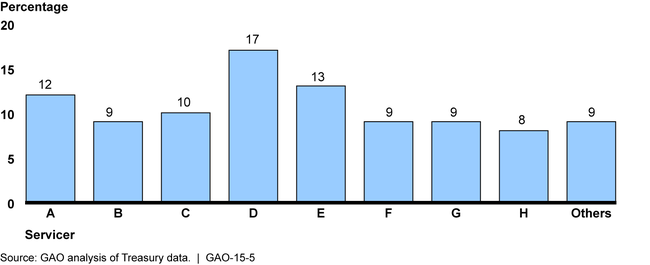

Treasury monitors HAMP denial and redefault rates, but its evaluation of data to help explain the reasons for differences among servicers is limited. GAO's analysis of HAMP data found wide variation among servicers in reasons for denials of trial modifications. Some of these variations may be due to differences in servicer practices that would not necessarily be identified by Treasury's compliance review process or analysis for reporting errors. GAO also identified wide variations in the probability of redefault even after controlling for differences in servicers' loan, borrower, and property characteristics, using available data (see figure). Federal internal control standards state that analyzing relationships among data helps inform control and performance monitoring activities. Without more fully evaluating servicer data, Treasury may miss opportunities to identify and address servicer weaknesses and assist and retain as many borrowers as possible.

Probability of HAMP Redefault for Large Servicers and Others after Controlling for Certain Loan, Borrower, and Property Characteristics, as of March 2013

Finally, Treasury has implemented most of GAO's past recommendations but has not fully implemented several that are intended to improve its oversight of the TARP-funded housing programs. For example, Treasury requires servicers to have controls in place for monitoring compliance with fair lending laws. But Treasury officials told us that they did not plan to assess these controls as GAO recommended because other federal agencies assess compliance with fair lending laws. Without such assessments, Treasury cannot determine whether servicers are complying with Treasury's requirement. As stated previously, implementing this recommendation and others would improve Treasury's oversight of TARP housing programs and help ensure that they assist and retain the greatest number of borrowers.

Why GAO Did This Study

Treasury introduced MHA in early 2009 and has allocated $38.5 billion in TARP funds to help struggling homeowners avoid potential foreclosure. The Emergency Economic Stabilization Act of 2008 requires GAO to report every 60 days on TARP activities. This 60-day report examines (1) the status of TARP-funded housing programs, (2) Treasury's efforts to monitor and evaluate HAMP denial and redefault rates among servicers, and (3) the status of the implementation of GAO's prior recommendations related to TARP-funded housing programs. To do this work, GAO reviewed program documentation, analyzed HAMP loan-level data, and interviewed knowledgeable Treasury officials.

Recommendations

GAO recommends that Treasury conduct periodic evaluations to help explain differences among MHA servicers (1) in the reasons they gave for denying applications for HAMP trial modifications and (2) in HAMP loan modification redefault rates. Such evaluations would help inform compliance reviews of individual servicers and help identify any needed program policy changes. Treasury agreed to consider making changes to its analytical methods for evaluating data on denial and redefault rates among individual servicers.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | To improve monitoring and oversight of Treasury's HAMP, the Secretary of the Treasury should conduct periodic evaluations to help explain differences among MHA servicers in reasons for denying application for trial modifications that may inform its compliance reviews of individual servicers, identify areas of weaknesses and best practices, and determine the potential need for additional program policy changes. |

Since report issuance, Treasury conducted two denial reason rate reviews in 2015--one looking at 11 MHA servicers with a high concentration of various denial reasons and the other looking at 7 MHA servicers--to understand the prevailing reasons for their use of specific denial reason codes (ineligible mortgage, request incomplete, and offer not accepted/withdrawn). According to Treasury officials, the results of these and other evaluations helped inform Treasury's decision to implement Streamline HAMP to help address the most common denial reason (i.e., failure to submit required documentation). Treasury also began conducting quarterly compliance reviews at the largest MHA servicers to verify the accuracy of denial reasons reported.

|

| Department of the Treasury | To improve monitoring and oversight of Treasury's HAMP, the Secretary of the Treasury should conduct periodic evaluations using analytical methods, such as econometric modeling as appropriate, to help explain differences among MHA servicers in redefault rates that may inform its compliance reviews of individual servicers, identify areas of weaknesses and best practices, and determine the potential need for additional program policy changes. |

Although Treasury has not performed econometric analyses of re-default rate by individual servicer, Treasury continues to monitor and report on the performance of Home Affordable Modification Program (HAMP) permanent loan modifications on a cohort basis (year loan was modified) and by other drivers of performance (payment reduction, credit score and delinquency status at time of modification, etc.). More specifically, consistent with the intent of the recommendation to monitor individual servicers, Treasury officials stated that they monitor default rates by servicer on a monthly basis. Treasury's current level of effort appears reasonable given that HAMP activity is winding down.

|