Identity Theft: Additional Actions Could Help IRS Combat the Large, Evolving Threat of Refund Fraud

Highlights

What GAO Found

Based on preliminary analysis, the Internal Revenue Service (IRS) estimates it paid $5.2 billion in fraudulent identity theft (IDT) refunds in filing season 2013, while preventing $24.2 billion (based on what it could detect). The full extent is unknown because of the challenges inherent in detecting IDT refund fraud.

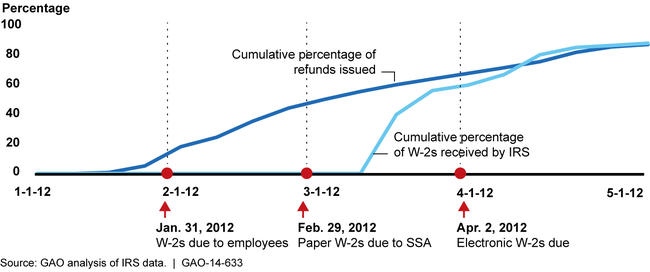

IDT refund fraud takes advantage of IRS's “look-back” compliance model. Under this model, rather than holding refunds until completing all compliance checks, IRS issues refunds after conducting selected reviews. While there are no simple solutions, one option is earlier matching of employer-reported wage information to taxpayers' returns before issuing refunds. IRS currently cannot do such matching because employers' wage data (from Form W-2s) are not available until months after IRS issues most refunds. Consequently, IRS begins matching employer-reported W-2 data to tax returns in July, following the tax season. If IRS had access to W-2 data earlier—through accelerated W-2 deadlines and increased electronic filing of W-2s—it could conduct pre-refund matching and identify discrepancies to prevent the issuance of billions in fraudulent refunds.

Time Delay Between Refund Issuance and IRS W-2 Posting Date, Filing Season 2012

Accelerated W-2 deadlines. In 2014, the Department of the Treasury (Treasury) proposed that Congress accelerate W-2 deadlines to January 31. However, IRS has not fully assessed the impacts of this proposal. Without this assessment, Congress does not have the information needed to deliberate the merits of such a significant change to W-2 deadlines or the use of pre-refund W-2 matching. Such an assessment is consistent with IRS's strategic plan that calls for analytics-based decisions, and would help IRS ensure effective use of resources.

Increased e-filing of W-2s. Treasury has requested authority to reduce the 250-return threshold for electronically filing (e-filing) information returns. The Social Security Administration (SSA) estimated that to meaningfully increase W-2 e-filing, the threshold would have to be lowered to include those filing 5 to 10 W-2s. In addition, SSA estimated an administrative cost savings of about $0.50 per e-filed W-2. Based on these cost savings and the ancillary benefits they provide in supporting IRS's efforts to conduct more pre-refund matching, a change in the e-filing threshold is warranted. Without this change, some employers' paper W-2s could not be available for IRS matching until much later in the year, due to the additional time needed to process paper forms.

Why GAO Did This Study

Identity theft tax refund fraud is a persistent, evolving threat to honest taxpayers and tax administration. It occurs when an identity thief files a fraudulent tax return using a legitimate taxpayer's identifying information and claims a refund.

GAO was asked to review IRS's efforts to combat IDT refund fraud. This report, the first of a series, examines (1) what IRS knows about the extent of IDT refund fraud and (2) additional actions IRS can take to combat IDT refund fraud using third-party information from, for example, employers and financial institutions.

To understand what is known about the extent of IDT refund fraud, GAO reviewed IRS documentation, including the Identity Theft Taxonomy . To identify additional actions IRS can take, GAO assessed IRS and SSA data on the timing of W-2s; and interviewed SSA officials and selected associations representing software companies, return preparers, payroll companies, and others.

Recommendations

GAO recommends that Congress should consider providing Treasury with authority to lower the annual threshold for e-filing W-2s. In addition, IRS should fully assess the costs and benefits of shifting W-2 deadlines, and provide this information to Congress. IRS neither agreed nor disagreed with GAO's recommendations, and it stated it is determining how these potential corrective actions align with available resources and IRS priorities.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider providing the Secretary of the Treasury with the regulatory authority to lower the threshold for electronic filing of W-2s from 250 returns annually to between 5 to 10 returns, as appropriate. | The Taxpayer First Act was enacted in July 2019 and will lower the e-filing threshold for all returns, including Forms W-2 over time (Public Law 116-25). Specifically, the act will lower the threshold to 100 returns in 2021 and to 10 in 2022 and later. This legislation builds on section 301 of the Tax Technical Corrections Act of 2018, division U of the Consolidated Appropriations Act, 2018 (Public Law 115-141), which lowered the e-filing threshold for partnerships. Lower thresholds for all W-2 filers will help the Internal Revenue Service prevent identity theft refund fraud and improper payments by enhancing its ability to verify the employment information reported on tax returns before issuing refunds. Additionally, increasing electronic filing of W-2 returns will lower the Social Security Administration's administrative costs for processing W-2 information. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should fully assess the costs and benefits of accelerating W-2 deadlines and provide information to Congress on the IRS systems and work processes that will need to be adjusted to accommodate earlier, pre-refund matching of W-2s and then identify timeframes for when these changes could be made. |

In September 2015, IRS presented Congress with a document detailing the costs and benefits of W-2 acceleration. The document discusses the IRS systems and work processes that will need to be adjusted to accommodate earlier, prerefund matching of W-2s, the time frames for when these changes could be made; potential impacts on taxpayers, IRS, other parties; and what other changes will be needed (such as delaying refunds) to ensure IRS can match tax returns to W-2 data before issuing refunds.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should fully assess the costs and benefits of accelerating W-2 deadlines and provide information to Congress on potential impacts on taxpayers, IRS, SSA, and third parties. |

In September 2015, IRS presented Congress with a document detailing the costs and benefits of W-2 acceleration. The document discusses the IRS systems and work processes that will need to be adjusted to accommodate earlier, prerefund matching of W-2s, the time frames for when these changes could be made; potential impacts on taxpayers, IRS, other parties; and what other changes will be needed (such as delaying refunds) to ensure IRS can match tax returns to W-2 data before issuing refunds.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should fully assess the costs and benefits of accelerating W-2 deadlines and provide information to Congress on what other changes will be needed (such as delaying the start of the filing season or delaying refunds) to ensure IRS can match tax returns to W-2 data before issuing refunds. |

In September 2015, IRS presented Congress with a document detailing the costs and benefits of W-2 acceleration. The document discusses the IRS systems and work processes that will need to be adjusted to accommodate earlier, prerefund matching of W-2s, the time frames for when these changes could be made; potential impacts on taxpayers, IRS, other parties; and what other changes will be needed (such as delaying refunds) to ensure IRS can match tax returns to W-2 data before issuing refunds.

|

| Internal Revenue Service | To provide timely, accurate, and actionable feedback to all relevant lead-generating third parties, the Commissioner of Internal Revenue should provide aggregated information on (1) the success of external party leads in identifying suspicious returns and (2) emerging trends (pursuant to section 6103 restrictions). |

As of December 2017, IRS had addressed GAO's August 2014 recommendation by developing timeliness metrics for managing leads, holding six feedback sessions with financial institutions participating in the External Leads Program, and sharing information through the Security Summit. In November 2015, IRS reported that it had developed a database to track leads submitted by financial institutions and the results of those leads. IRS also stated that it had held six sessions with financial institutions to provide feedback on external leads provided to IRS. These quarterly feedback sessions contained various types of information, including overall statistics for the External Leads Program, individual statistics tailored to a specific external party, and solicitations for how to improve the program. In December 2015, IRS officials stated that the agency sent a customer satisfaction survey asking financial institutions for feedback on the external leads process and was considering other ways to provide feedback to financial institutions. In March 2017, IRS officials told GAO they were holding more frequent, monthly, feedback sessions with financial institutions. Additionally, IRS provides feedback and information sharing to financial institutions through the Security Summit. IRS provided information on the Security Summit's Financial Services Working Group's weekly meetings. These meetings covered new and emerging fraud trends, new ideas on fraud prevention and overall statistics for the External Leads Program to the Security Summit's Financial Services Working Group participants. In December 2017, 8 of the 11 financial institutions who responded to GAO's outreach said that IRS's feedback was timely, meaningful, and actionable. Further, one organization told GAO that IRS's feedback was substantially improved from 2014. Accurate, timely, and actionable feedback to external parties participating in the External Leads Program informs them if the leads they provide to IRS are useful and enables them to assess their success in identifying identity theft refund fraud and improve their detection tools.

|

| Internal Revenue Service | To provide timely, accurate, and actionable feedback to all relevant lead-generating third parties, the Commissioner of Internal Revenue should develop a set of metrics to track external leads by the submitting third party. |

As of December 2017, IRS had addressed GAO's August 2014 recommendation by developing timeliness metrics for managing leads, holding six feedback sessions with financial institutions participating in the External Leads Program, and sharing information through the Security Summit. In November 2015, IRS reported that it had developed a database to track leads submitted by financial institutions and the results of those leads. IRS also stated that it had held six sessions with financial institutions to provide feedback on external leads provided to IRS. These quarterly feedback sessions contained various types of information, including overall statistics for the External Leads Program, individual statistics tailored to a specific external party, and solicitations for how to improve the program. In December 2015, IRS officials stated that the agency sent a customer satisfaction survey asking financial institutions for feedback on the external leads process and was considering other ways to provide feedback to financial institutions. In March 2017, IRS officials told GAO they were holding more frequent, monthly, feedback sessions with financial institutions. Additionally, IRS provides feedback and information sharing to financial institutions through the Security Summit. IRS provided information on the Security Summit's Financial Services Working Group's weekly meetings. These meetings covered new and emerging fraud trends, new ideas on fraud prevention and overall statistics for the External Leads Program to the Security Summit's Financial Services Working Group participants. In December 2017, 8 of the 11 financial institutions who responded to GAO's outreach said that IRS's feedback was timely, meaningful, and actionable. Further, one organization told GAO that IRS's feedback was substantially improved from 2014. Accurate, timely, and actionable feedback to external parties participating in the External Leads Program informs them if the leads they provide to IRS are useful and enables them to assess their success in identifying identity theft refund fraud and improve their detection tools.

|