Air Force Working Capital Fund: Actions Needed to Manage Cash Balances to Required Levels

Highlights

What GAO Found

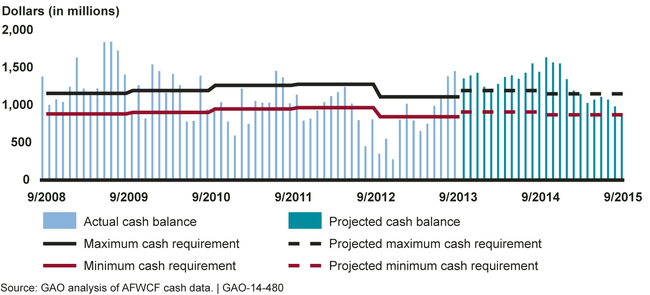

GAO's analysis of Air Force Working Capital Fund (AFWCF) cash data showed that monthly cash balances fell within the minimum and maximum cash requirements about one-third of the time in fiscal years 2009 through 2013. GAO identified three reasons why monthly cash balances were above the maximum or below the minimum cash requirements. First, the cash balance began fiscal year 2009 above the maximum requirement and generally remained above the maximum requirement in fiscal years 2009 and 2010 because the AFWCF charged more than it cost for spare parts. Second, cash balances fluctuated each year because of the cyclical nature of events. For example, in the spring and summer months, the Air Force flies more training missions, which increases revenue for parts and thus the cash balance. Finally, large-dollar transactions caused cash balances to fluctuate above and below cash requirements. These transactions were used to increase cash to pay for costs such as fuel price increases or reduce cash if it was above the maximum requirement.

AFWCF Monthly Cash Balances Compared to Cash Requirements

AFWCF projected monthly cash balances are expected to fall within cash requirements about 25 percent of the time in fiscal years 2014 and 2015. In managing cash for those fiscal years, the AFWCF faces three challenges:

The AFWCF plans to implement a Department of the Treasury initiative to provide daily cash balances, instead of monthly balances, in October 2014. Because daily balances are more volatile, the AFWCF faces a greater risk that a cash shortfall would occur. However, the Department of Defense (DOD) has not updated its regulation on receiving daily cash balances.

Because airlift rates are set to compete with private sector rates, they do not cover the full cost. The difference between the full cost and revenue received is to be provided by the Airlift Readiness Account (ARA) funded by the Air Force. The projected cash balance declines in fiscal year 2015 because the Air Force did not fully fund the ARA by $927 million. If a cash shortfall materializes, the Air Force stated its intent to fund the requirement from other programs. Without sufficient ARA funding, the AFWCF cash balance is at risk of falling below the minimum cash requirement in fiscal year 2015.

The AFWCF has included $620 million in savings from Air Force and United States Transportation Command initiatives in its fiscal year 2015 projected monthly cash balances. If these saving are not realized, the Air Force may need to take action to reduce the risk of a cash shortfall.

Why GAO Did This Study

The AFWCF earned revenue of $21.2 billion in fiscal year 2013 by, among other things, (1) repairing aircraft and engines; (2) selling inventory items (parts); and (3) providing air, land, and sea transportation. Cash generated from the sale of goods and services is used by the AFWCF to cover its expenses, such as paying employees. As requested, GAO reviewed issues related to AFWCF cash management.

GAO's objectives were to determine to what extent (1) the AFWCF monthly cash balances were within the DOD minimum and maximum cash requirements for fiscal years 2009 through 2013 and (2) the AFWCF projected monthly cash balances were within the minimum and maximum cash requirements for fiscal years 2014 and 2015 and if not why. To address these objectives, GAO reviewed relevant DOD cash management guidance, analyzed AFWCF actual and projected cash balances and related data, and interviewed Air Force and United States Transportation Command officials.

Recommendations

GAO is making three recommendations to DOD that are aimed at implementing the Department of the Treasury's daily cash balance initiative and ensuring that the AFWCF receives the appropriate funding if a cash shortfall occurs because of a lack of ARA funding or estimated savings not being realized. DOD concurred with GAO's recommendations and cited related actions planned or under way.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | To improve the management of the AFWCF's cash balances, the Secretary of Defense should direct the Under Secretary of Defense (Comptroller) to update the DOD Financial Management Regulation to include guidance on (1) maintaining sufficient cash balances on a daily basis to avoid potential Antideficiency Act violations and (2) the reconciliation of daily cash balances to ensure the integrity and accuracy of the data once DOD implements Treasury's initiative. |

In July 2014, GAO reported that the Department of the Treasury was modernizing and streamlining its reporting processes through its government-wide accounting initiative. One result of this initiative will be for Treasury to provide daily cash balances for all appropriations, including the Air Force Working Capital Fund (AFWCF), beginning in fiscal year 2015. We reported that when DOD implements Treasury's daily cash initiative, the Financial Management Regulation will need to be updated to reflect the new requirement for daily, rather than monthly, cash reporting. We recommended that DOD update the Financial Management Regulation to include guidance on maintaining sufficient cash balances on a daily basis to avoid potential Antideficiency Act violations. DOD concurred with our recommendation and updated the DOD Financial Management Regulation, Volume 2B, Chapter 9 in 2015 to provide guidance on how to maintain sufficient cash balances on a daily basis to avoid potential Antideficiency Act violations. As part of the guidance, DOD developed a new model for determining the minimum and maximum cash requirements based on four factors including the rate of disbursement, range of operation, risk mitigation, and cash reserves. DOD directed the DOD Working Capital Funds, including the AFWCF, to use the updated Financial Management Regulation for determining their minimum and maximum cash requirements beginning with fiscal year 2017 budget development. With the implementation of this new cash requirements model, DOD Working Capital Funds should have sufficient cash balances to avoid Antideficiency Act violations under Treasury's daily cash reporting.

|

| Department of Defense | To improve the management of the AFWCF's cash balances, the Secretary of Defense should direct the Secretary of the Air Force and the Commander of the United States Transportation Command to take steps to help ensure that the AFWCF receives the appropriate funding if a cash shortfall occurs because of (1) the implementation of the daily cash requirement, (2) a lack of fiscal year 2015 ARA funding, and (3) fiscal year 2015 budgeted savings not being realized. |

In July 2014, GAO reported that the Air Force Working Capital Fund (AFWCF) would face three challenges in fiscal year 2015 that could reduce its cash balance below the minimum requirement by the end of fiscal year 2015. These challenges were (1) the AFWCF plans to implement a Department of the Treasury initiative to provide daily cash balances, instead of monthly cash balances, in October 2014 -- increasing the volatility of the fund; (2) the Air Force did not fully fund the Airlift Readiness Account in the fiscal 2015 budget; and (3) the AFWCF included hundreds of millions of dollars in potential savings from Air Force and United States Transportation Command initiatives in its fiscal year 2015 projected monthly cash balances that may not materialize. GAO recommended that the Air Force and the United States Transportation Command take the necessary steps to ensure the AFWCF receives the appropriate funding if a cash shortfall occurs. DOD concurred with our recommendation and stated that cash levels and potential shortfalls are monitored closely, and if an unfavorable trend develops, appropriate actions will be taken. In order to address any potential shortfall, the Air Force increased the cash balance of the AFWCF by about $900 million in fiscal year 2015. With the increased cash balance, the Air Force had sufficient funds to address any potential liabilities.

|

| Department of Defense | To improve the management of the AFWCF's cash balances, the Secretary of Defense should direct the Secretary of the Air Force, in conjunction with the Under Secretary of Defense (Comptroller), to develop an analytical approach for calculating the minimum and maximum cash requirements to take into consideration the additional cash needed to cover the day-to-day volatility in the cash balances once DOD implements Treasury's initiative. |

In July 2014, GAO reported that the Department of the Treasury was modernizing and streamlining its reporting processes through its government-wide accounting initiative. One result of this initiative will be for Treasury to provide daily cash balances for all appropriations, including the Air Force Working Capital Fund (AFWCF), beginning in fiscal year 2015. We reported that when DOD implements Treasury's daily cash initiative, the AFWCF faces a greater risk that cash shortfall will occur because daily cash balances are more volatile than monthly cash balances. We recommended that Air Force, in conjunction with the Under Secretary of Defense (Comptroller) develop an analytical approach for calculating the minimum and maximum cash requirements to take into consideration the additional cash needed to cover the day-to-day volatility in the cash balances once DOD implements Treasury's Initiative. DOD concurred with our recommendation and Office of the Under Secretary of Defense (Comptroller), Revolving Fund Directorate, devised a new policy requiring Working Capital Fund activities maintain positive balances throughout the year and adequate ending balance to support continuing operations into the subsequent year. The new cash model for determining the minimum and maximum cash requirements is based on four factors: (1) the rate of disbursement, (2) range of operation, (3) risk mitigation, and (4) cash reserves. The Air Force used this new model to determine the minimum and maximum AFWCF cash requirements for fiscal years 2015 through 2017 reported in the AFWCF fiscal year 2017 budget. In addition, to reduce the volatility and the risk of insolvency in the AFWCF cash account, the Air Force increased the number of collection cycles per month for its largest customer. With the implementation of this new cash requirements model and the increased collection cycles, the AFWCF should have sufficient cash balances to avoid Antideficiency Act violations under Treasury's daily cash reporting.

|