Retirement Security: Challenges for Those Claiming Social Security Benefits Early and New Health Coverage Options

Highlights

What GAO Found

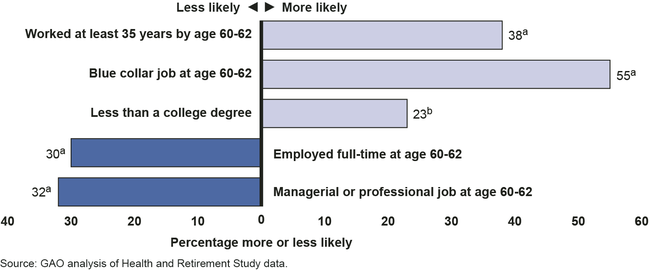

Several work-related factors may cause people to claim Social Security benefits early and suggest they may face challenges in continuing to work at older ages. For example, those who worked in physically-demanding blue collar jobs were 55 percent more likely to claim benefits prior to their full retirement age compared to those in all other occupations after controlling for other factors (see figure). Those who were out of the workforce or had longer work histories by age 60-62 were also significantly more likely to claim early. In addition to work-related characteristics, other factors, such as having poorer expectations of living to age 75 significantly increase the likelihood of claiming early.

Work-Related Factors Affecting the Likelihood of Claiming Benefits Early

a Indicates that this variable is statistically significant at the 99 percent level.

b Indicates that this variable is statistically significant at the 90 percent level.

Those who delay claiming until their full retirement age tend to have greater income and wealth in retirement and rely less on Social Security than those who claim earlier. Our analysis shows that the median income for those who delay was 45 percent higher after claiming benefits than for those who claimed early, and 33 percent higher at age 72. Although delayed claimers have higher median Social Security benefits, those benefits make up a smaller portion of household income than for early claimers. Even when comparing early and delayed claimers with similar total income after claiming, average household income for delayed claimers was higher at age 72 than for early claimers. However, for both early and delayed claimers, Social Security benefits accounted for an increasing share of total income as they aged.

In 2014, some early claimers, especially those without access to health coverage, may benefit from certain provisions of the Patient Protection and Affordable Care Act (PPACA) intended to improve the availability and affordability of health coverage. GAO estimates that nearly a million early claimers did not have government or employer-sponsored health insurance before 2014. Of these, 14 percent may be newly eligible for Medicaid in 2014 due to expansion in 25 states and the District of Columbia and 58 percent could be eligible for tax credits that reduce the premiums for coverage purchased through the new health insurance exchanges. However, GAO estimates that 10 percent of these early claimers had incomes below the federal poverty level but lived in states that did not expand Medicaid and had incomes too low for federal exchange tax credits.

Why GAO Did This Study

Deciding when to retire and claim Social Security benefits can be one of the most important financial decisions older Americans make. Despite higher monthly benefits for those who delay, many people still claim Social Security retirement benefits at age 62, the earliest age of eligibility. In 2014, these early claimers will see their monthly benefits reduced by 25 percent compared to what they would have received if they had delayed claiming until age 66, the current full retirement age. At the same time, some early claimers do not have access to government or employer-sponsored health insurance. These early claimers may have been able to purchase coverage on the individual market, but they may have also been subject to denials and rate increases because of their health status.

To better understand the circumstances faced by those who claim early Social Security benefits, GAO examined: (1) demographic and occupational characteristics associated with early claiming; (2) retirement income of early claimers compared to those who delay; and (3) how PPACA changes health coverage options for early claimers. More specifically, GAO examined the characteristics and income of early claimers using data from the Health and Retirement Study, as well as the eligibility for PPACA insurance programs using 2009-2011 American Community Survey data.

GAO received technical comments on a draft of this report from the Department of Labor and the Social Security Administration and incorporated them as appropriate.

For more information, contact John Dicken, (202) 512-7114, dickenj@gao.gov or Charles Jeszeck, (202) 512-7215, jeszeckc@gao.gov .