Overseas Allowances: State Should Assess the Cost-Effectiveness of Its Hardship Pay Policies

Fast Facts

The Department of State provides two types of additional compensation for employees working in challenging overseas areas: hardship pay and danger pay. When employees temporarily leave those posts, State adjusts the pay.

While danger pay is automatically adjusted, State's procedures for adjusting hardship pay are resource intensive—involving 10,000 manual adjustments each year—and contributed to $2.9 million in payment errors between 2015 and 2016.

We recommended that State assess its hardship pay policies and increase its efforts to identify, recover, and prevent payment errors.

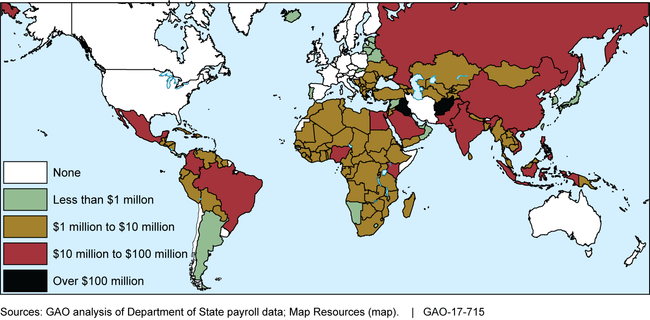

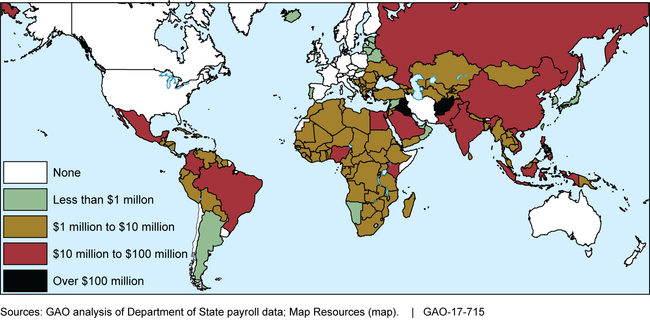

Department of State Spending for Hardship and Danger Pay, Fiscal Years 2011-2016

Map of global spending for hardship and danger pay for fiscal years 2011-2016.

Highlights

What GAO Found

The Department of State (State) spent about $732 million for hardship pay and $266 million for danger pay at overseas posts in fiscal years 2011 through 2016.

Department of State Spending for Hardship and Danger Pay, Fiscal Years 2011-2016

State has mostly followed its process for determining hardship and danger pay rates at overseas posts. To determine hardship rates, State calculates scores for overseas posts based on information from post surveys and data on factors such as air pollution and crime. GAO reviewed scores for 192 posts and found that State mostly followed its process. However, in 12 of 15 cases where State added points for extreme conditions not captured in its written standards—Director Points—it did not clearly document how posts met these criteria. Without adequate documentation, the department cannot ensure that it is awarding these points consistently. For danger pay, State followed a process that bases rates on threat levels for political violence and terrorism and whether family members are allowed at post.

State’s procedures for stopping and starting hardship pay when employees temporarily leave posts—based on several factors—are resource intensive, but State has not assessed their cost-effectiveness. State uses diplomatic cables to adjust hardship pay, but these procedures are resource intensive—requiring 10,000 pay actions each year—and contribute to improper payments, which are costly to recover. State’s procedures for adjusting danger pay through time and attendance, based on whether or not employees are present at posts, are mostly automated. State has not assessed the cost-effectiveness of its hardship pay policies and procedures in accordance with its Foreign Affairs Manual.

State identified $2.9 million in improper payments related mostly to hardship pay in fiscal years 2015-2016. State conducts required improper payments audits but has not analyzed available data that could help further identify and recover overpayments related to hardship pay. Guidance from the Office of Management and Budget notes that such data analysis could be part of an internal control program to prevent, detect, and recover overpayments.

Why GAO Did This Study

State provides hardship and danger pay, among other allowances, as incentives for State personnel to work at challenging overseas locations. Hardship pay compensates employees for service at overseas posts where conditions differ substantially from those in the United States. Danger pay compensates employees for service at posts where civil insurrection, civil war, terrorism, or wartime conditions threaten the health or well-being of an employee.

This report examines hardship and danger pay, specifically, (1) State’s spending at overseas posts in fiscal years 2011-2016, (2) the extent to which State has followed its process for determining rates, (3) the procedures State uses to implement its policies for starting and stopping hardship and danger pay, and (4) the extent to which State has identified improper payments. GAO analyzed State data and documents; interviewed State officials in Washington, D.C.; and conducted fieldwork at four posts that receive hardship or danger pay: Islamabad, Pakistan; Mexico City, Mexico; New Delhi, India; and Tunis, Tunisia.

Recommendations

GAO recommends that State clearly document the use of Director Points for extreme conditions at posts; assess the cost-effectiveness of its policies and procedures for stopping and starting hardship pay for overseas employees; and analyze available data to identify, recover, and prevent improper payments related to hardship pay. State concurred with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of State | The Director of the Office of Allowances (ALS) should clearly document how the conditions at relevant posts meet the criteria for Director Points to ensure that hardship pay rates for overseas posts are consistently determined across posts and tenures of ALS Directors. (Recommendation 1) | State concurred with GAO's recommendation. However, as of November 2020, ALS had not awarded any Director Points since the publication of GAO-17-715 in September 2017. Therefore, to address this recommendation, on November 3, 2020, the ALS has established a new process that requires the Director of ALS to submit an Action Memo to the Deputy Assistant Secretary of the Bureau of Administration seeking approval for Director Points. The memo must clearly document how the conditions at relevant posts meet the criteria for Director Points. Clearly documenting the rationale for using Director's Points will enable State to provide assurances that it is applying Director Points fairly across... posts and tenures of ALS Directors.

View More |

| Department of State |

Priority Rec.

The Undersecretary of Management should assess the cost-effectiveness of State's policies and procedures for stopping and starting hardship pay for employees who temporarily leave their assigned overseas posts. (Recommendation 2) |

State concurred with this recommendation. In April 2021, State completed a comprehensive review of all costs associated with the processing of hardship pay. Following this review, in June 2021, State adopted a simplified rule for stopping and starting hardship pay that aims to increase compliance, apply the allowance equitably, and reduce the heavy administrative burden of tracking arrivals and departures from posts. While the Department expects to see an increase in hardship pay due to this rule, it also expects to see a reduction in administrative costs associated with processing hardship pay that will offset those costs and increase fairness.

|

| Department of State |

Priority Rec.

The Department's Comptroller should analyze available diplomatic cable data from overseas posts to identify posts at risk of improper payments for hardship pay, identify any improper payments, and take steps to recover and prevent them. (Recommendation 3) |

State concurred with this recommendation. According to State, it continues to identify and seek repayment of improper payments and communicate the importance of timely actions to the regional bureaus and posts to ensure improper payments do not occur. In addition, the Bureau of the Comptroller and Global Financial Services (CGFS) has implemented the Overseas Personnel System, which centralizes the collection of arrival and departure data for the calculation of improper payment notification and risk analysis. It is also rolling out a new self-service portal which would eliminate the cables required for turning on and off hardship pay, when fully implemented. Moreover, officials believe...

|